Hurricane Ian Insurance Claims Lawyers

Damage after Hurricane Ian struck Florida

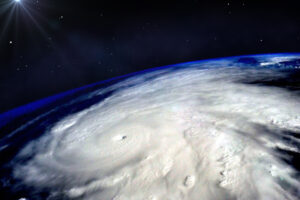

Hurricane Ian ripped across the state of Florida at the end of September of 2022, causing extensive property damage and the loss of life. Many areas along the Gulf Coast of Florida required significant and historic emergency response efforts, and the infrastructure of several areas was destroyed, leaving people without necessary resources. Even areas outside of the hurricane’s initial landfall in the interior of the state experienced devastating problems from hazards such as wind damage, flooding, tornadoes, and falling trees or poles. Hurricane Ian will be remembered as one of the most destructive in Florida’s history.

Hurricanes and insurance companies

Aside from these effects on people and property, major hurricanes such as Ian also tend to create insurance issues for thousands or millions of Florida residents. Most people living in the state have homeowners insurance, along with flood insurance if they are in a flood zone. However, there are a number of different scenarios that can play out when someone tries to get financial assistance from their insurance provider, and the help of Hurricane Ian insurance claims attorneys may be necessary. Professional help from Hurricane Ian homeowners insurance claim lawyers is especially important when an insurance company has denied a claim outright or offered a very low settlement amount. Here are a few things to know about the insurance process following a storm and why legal advice is often recommended for a favorable resolution.

Homeowners insurance claims following Hurricane Ian

There is a formal process that should be followed to get assistance after any severe weather event. When a homeowner or other property owner experiences significant damage, it is best for them to inventory and document their losses, report them to their insurance provider, and submit evidence to support their claim as soon as they possibly can. In ideal situations, this is supposed to result in the insurance company reviewing the information, making a decision regarding the value of the claim based on the policy information such as the owner’s deductible, and then issuing funds to assist with the costs. Insurance adjusters are used to verify the damage, and when a homeowner disagrees with an insurance adjuster’s opinion, they can attempt to have their damage reviewed again by a different party. Some homeowners may go through this process without issue, and they may be satisfied with their insurance company and the amount they were paid for repairs. It is also fairly common for the insured person and their provider to have various disputes.

Problems with insurance companies who refuse to pay for property damage

Property owners are often surprised to find out just how difficult an insurance company can be to deal with, even after they have been paying for a policy for an extended period of time without making a claim. This can include difficulties getting in touch with the right person to address their concerns, very small payments for damage, or not responding at all after the claim was filed. An appeal process may be available if the homeowner disagrees with the assessment and value of the damage, but the ability to get proper relief through the appeal system used by most insurance providers is limited.

Many homeowners will find that they simply do not have the time to review their entire policy and deal with evasive insurance companies. A good alternative for many who have experienced property losses is get in touch with a Hurricane Ian homeowners insurance claim denial lawyer or firm that can represent their interests.

Hurricane Ian property damage lawyers in Florida

Hurricane Ian property damage attorneys can often be the best and most direct way for those who owned affected homes to get assistance. Insurance companies who were saturated with new claims related to the storm may engage in tactics such as excessive delays or bad faith to deny legitimate claims. Sometimes, it takes the experience and knowledge of a professional insurance attorney to notice these kinds of issues and ensure that the insurance company is not breaking the law or engaging in other unfair tactics that are designed to frustrate the claimant.

Florida insurance claim denials

There are a number of reasons why a person may need to speak with Hurricane Ian insurance claims denial attorneys after submitting their claim to their provider and then receiving notice of a denial. In some cases, there can be legitimate reasons to deny a hurricane damage claim. This can include the type of damage in question not being covered under the active policy, the claimant waited too long, and the time limit to file the claim has passed. To prevent these kinds of problems, property owners should see if they need standard homeowners insurance, flood insurance, or other kinds of coverage to protect all structures and assets on their property.

Responding with the help of Hurricane Ian insurance claims denials lawyers

It is also important to realize that insurance companies are businesses, and they will go to great lengths to avoid paying out claims and save money. In extreme cases, this can result in legitimate claims not being reviewed properly, and the insurance company will often give some kind of vague or unreasonable excuse.

If anyone who has made a claim feels like they are getting nowhere when trying to get answers from their insurance company, a Hurricane Ian property damage insurance claim lawyer can take action to ensure that they are following Florida’s insurance laws. This may include looking at the terms of the policy, reviewing what the insurance provider did after receiving notice and the claim, and seeing if any bad faith or illegal acts may be present. Negotiations with an insurance company may also be conducted by a lawyer who needs to attempt to get their client more money after an initial low offer.

Additional information about getting help with property damage caused by Hurricane Ian in Florida

Madalon Law is a trusted firm with offices throughout Florida that is available to help those who are experiencing issues with insurance claims from Hurricane Ian. Their licensed attorneys can review the situation and provide a detailed course of action that will give property owners the best chance of receiving sufficient financial assistance.