Insurance Claim Denial Lawyers in Venice, Florida

Trouble when submitting an insurance claim

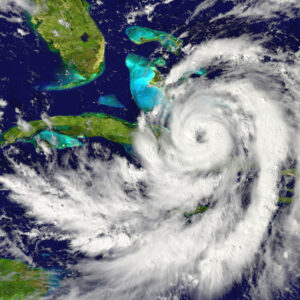

Filing insurance claims and receiving money for repairs for property damage is not always a straightforward process. Homeowners in Venice and other parts of Florida may need financial assistance with paying for hurricane damage, flooding, and other types of property damage caused by accidents and natural disasters. When insurance providers are supposed to assist at this time, there have been many documented issues in recent years with homeowners insurance companies trying to pay customers much less than they need or denying their claims in bad faith.

Because insurance companies are often difficult to deal with, advice from Venice Florida hurricane damage insurance claims attorneys is usually the best option for a person who has had their claim denied or severely underpaid. Here is an overview of the insurance process and how problems can potentially happen.

Hurricane damage attorneys in Venice, Florida

Hurricane damage can be stressful, not only because of the damage itself and the process to make repairs, but also because of the potential for financial issues and problems during the insurance claim process. A homeowner may need to make extensive repairs to replace their roof, the house can be flooded or covered in water damage, and various items could have been damaged during the storm. The person should create an inventory of these losses and notify their insurance company of their intent to file a claim as soon as possible. If an insurance adjuster reviews the damage, the homeowner should take note of any concerns, such as the adjuster giving a very low damage estimate. There is an appeal process to dispute issues that arise with the damage estimates and the adjuster that can be helpful, but the insurance provider will ultimately try to save money any way that they can.

After the claim is submitted, having frequent and consistent communication with the insurance provider is a good way to avoid many of the problems associated with the insurance process. When the insurance company is being evasive, misleading the claimant, or denying a claim dispute the property owners best efforts, insurance claims attorneys in Venice Florida can be necessary to assist.

Help from homeowners insurance claims denial lawyers

Homeowners insurance is required for many people who have mortgaged their property. It is also a significant financial expense, as insurance premiums have an average cost of several thousand dollars a year in Florida, and these costs can be even higher if the home is located in a flood zone and an additional flood insurance policy is required.

Even when the insurance company is being paid as required, a homeowners insurance policy is not a guarantee that all damage will be covered. First, homeowners should realize that policies have limitations on the type of damage that the insurance company will pay for, and there is also a deductible that the homeowner is expected to pay out of pocket before the insurance company will cover the rest of the damage. The homeowner also needs to be careful that they do not make any mistakes while filing their claim, as this can result in additional delays or a total denial from the insurance company. There are also mistakes made by insurance providers which are caused by administrative and clerical errors. Finally, the homeowners insurance company may offer a settlement, but the amount is much too small to cover the damage in question. In any of these situations, Venice Florida hurricane damage insurance claims lawyers can review the situation and provide advice regarding an appeal of the denial or other potential actions.

When a claim is denied in bad faith

Insurance providers do not always follow the terms of their own policies and rules that regulate the state’s insurance industry in Florida. In some cases, an insurance company can choose to deny a claim that should have been covered under the terms of the policy in place. If this happens, it is called a bad faith claim denial and the property owner has a number of different remedies available to try to get help. The insurance company can be sued for their actions and they may be made to pay out damages to the claimant. There are also problems with pursuing bad faith claims for many property and homeowners, as this kind of action by an insurance company is not always easy to notice or detect. If a claimant has had their claim denied and there is the potential for bad faith, an investigation by insurance claims denial attorneys in Venice FL is often the best way to proceed. There may be large amounts of documentation and other items to review in order to determine why the claim was denied and if further action against the insurance company is warranted. If the case against the insurance provider is successful, the homeowner may receive the compensation necessary to repair their home along with other types of damages.

Venice Florida Insurance claims denial lawyers are available

Madalon Law is a firm that handles matters related to property damage and insurance claims in the state of Florida. Their insurance claims attorneys in Venice Florida are licensed in Florida and they have extensive experience working with insurance companies to get their clients the money that they need. An initial consultation is the best way to get started with this process and receive personal advice.